About Us ( Ciel Tax Corporation )

Hello there, our office is located in Nishinomiya City where is easily accessible from both Kobe and Osaka by train, just 20-30 minutes to get here. We also conduct on-line virtual meeting to support distant clients.

Address;〒662-0911, #310 Furente Nishikan 9-7,Nishinomiya-City, Hyogo, Japan

TEL;+81-798-31-6745 / e-mail; info@cieltax.jp (inquiry form is here)

1 minute walk from JR Nishinomiya station

Availability

April… We can accept 1 new clients.

May… We can accept 2 new clients.

For further inquiries, please send an email ; info@cieltax.jp

Our Servise

Bookkeeping and Accounting

Often time’s clients ask for our expert opinions on book keeping and accounts while others ask us to go through there provided information. Please check the Price List below.

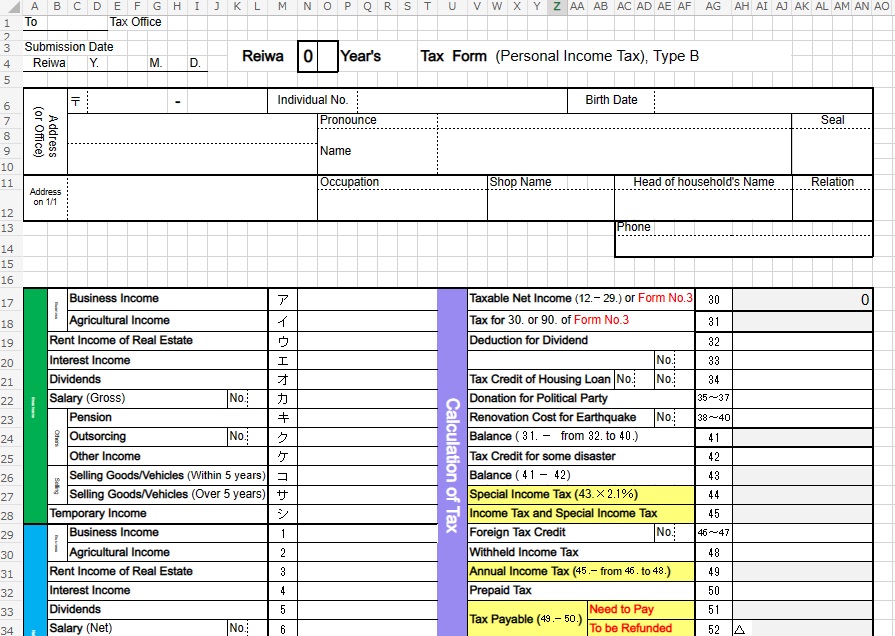

Tax Forms as Excel Template

The Tax form can be downloaded in either Japanese or English Excel versions.

If you would like to download them, please CLICK HERE

Consultation, one-time / monthly

We engage our clients via Zoom, Skype, E-mail or other SNS.

Inter-personal relationship is still advocated and we ask you to let us know which best suits your time and business schedule.

Consultation for applying business loans

We also render on the spot business advise when meeting with the bank officers.

( This service is basically for our regular clients only)

CLICK HERE for more information,

Price List

Case 1; Minimum Plan

200,000yen ~ (inc. tax)

This price is applied to companies/persons who know well about bookkeeping and can input data by themselves.

* For detail quotation, CLICK HERE

* For detail of service,CLICK HERE

Case 2; Full Service Plan

400,000yen ~ (inc. tax)

This price is applied to the most cases.

*For detail quotation, CLICK HERE

*For detail of service, CLICK HERE

Case 4; One-time consultation

8,000 yen per one-time (inc. tax)

※ While Dec. ~ Mar., 10,000 yen per one-time (inc. tax)

If you prefer to have a one-time consultation, please contact me by email in advance to set up an appointment at my office.

When it’s difficult to meet in person, we’re available for using e-mail, Zoom, or any other on-line communication.

8,000yen is needed for 1 topic as long as it’s not a complicated question.

Case 5; Individual Tax Return

1) Most simple type ; 11,000~33,000yen (inc. tax)

・Salaries, deductible medical expenses or donations.

・doesn’t include any foreign income.

2) Others ; ¥88,000~ (inc. tax)

Please let us know the type of document and its required contents in advance by email and we’ll make the quotation.

1. Please make an appointment when you’d like to meet in person with us.

2. We think e-mail will be better as a first contact, to avoid misunderstanding.

3. When you prefer to phone call, please call between 9 am to 5 pm (Japan Standard Time).