Hello everyone,

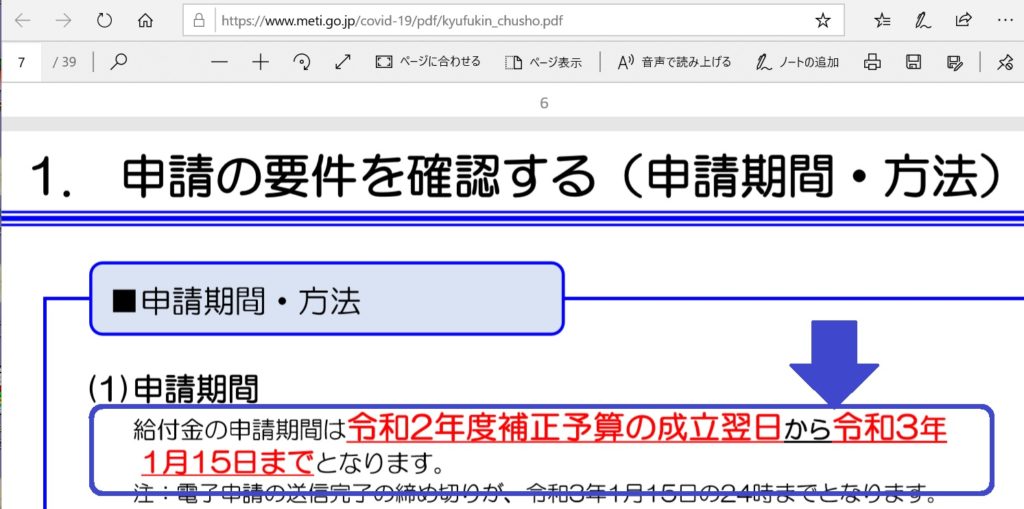

Many people ask me about 持続化給付金(Jizokuka-Kyufukin), that is,

Business Continuity Benefit.

This Cash Benefit will be applicable from 01/05/2020 (at fastest) ,

and be continued until 15/01/2021. (see that below)

↓ ↓ ↓

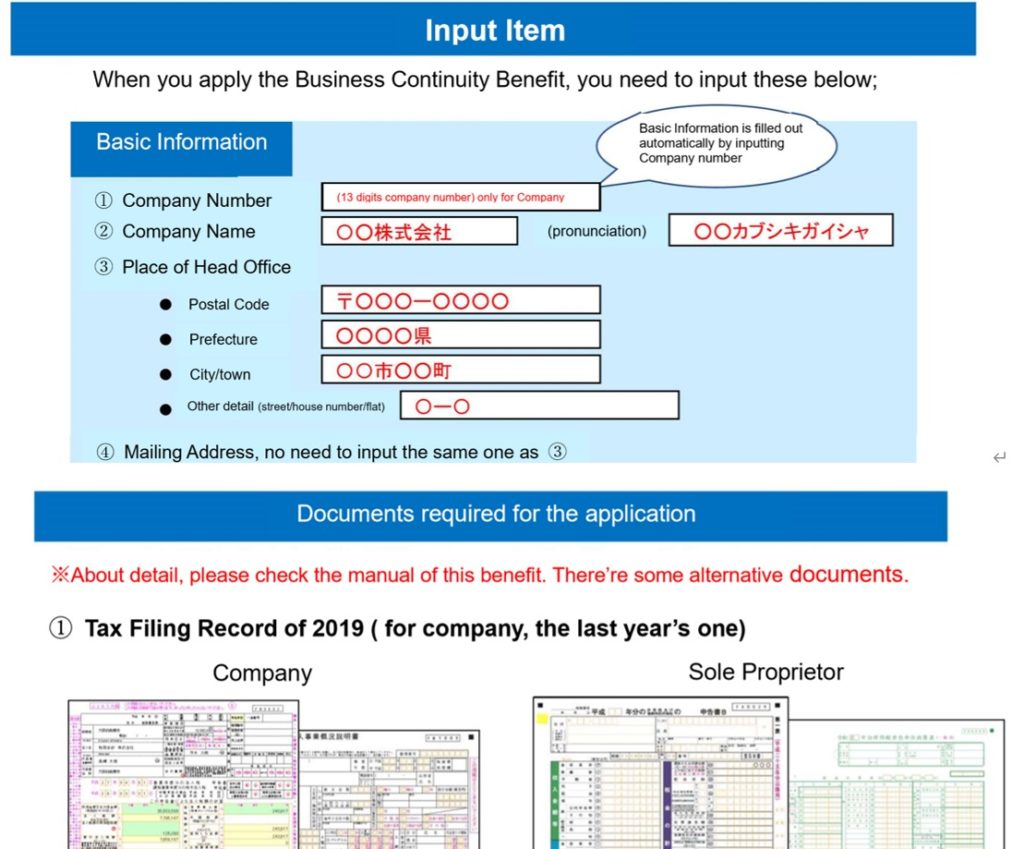

As you know, basically this apply should be done via on-ilne.

Goverment shows the required input item.

(This figure is my translation of breaking news.)

That figure above is just part of guidance.

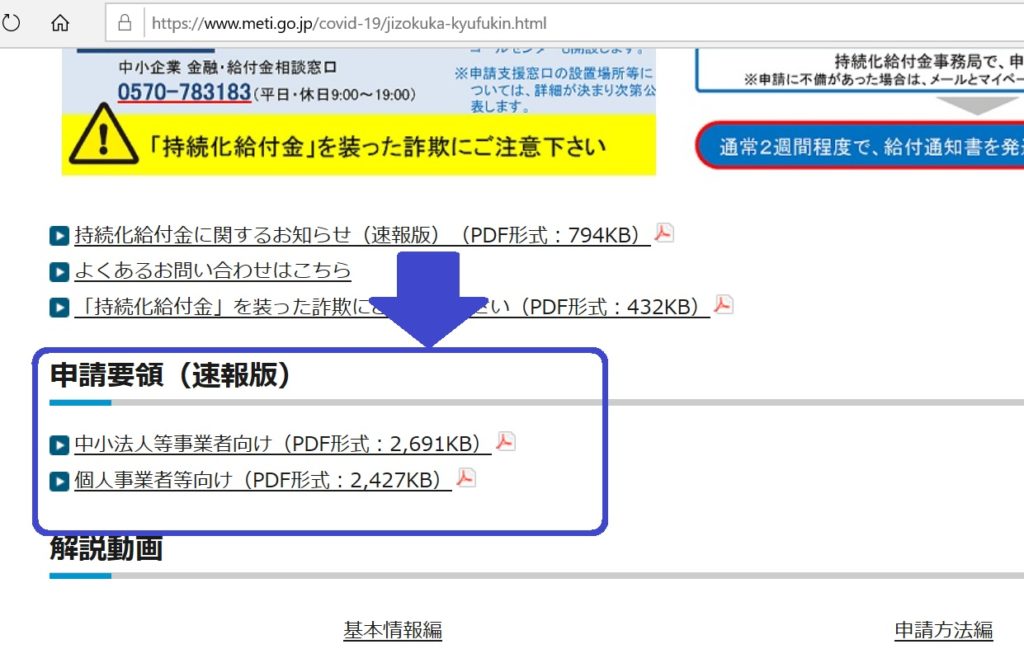

The official guidances are uploaded at goverment website.

It’s over 30 pages!

So I picked up important two pages.

Yes, this Benefit is not “fixed amount”one.

If you’ll input the figure and required information correctly,

receivable amount is automatically calculated.

But, there’re some Exceptional calculation way as I mentioned above PDF.

And also, don’t forget preparing copy of tax filing and other documents.

I’m sorry I can’t help you out, meeting face to face.

If you want short-version guidance translated in English,

please pay 8,000yen for me and I’ll send it to you.

(original Japanese version is below)

https://www.meti.go.jp/covid-19/pdf/kyufukin.pdf

Sorry I’m too tied up to translate detail version one (over 30 pages!)

So, if you want ask me, I’m appriciated if you use e-mail first.

※Please take note that I can’t reply to your e-mail soon.

Have a nice day !

Nagaoka Reiko Accounting Office

https://cieltax.jp/english.html