Hello everyone,

From October 1st 2019, Sales tax rate will be changed from 8% to 10%.

Everyone knows about it, but, I don’t think many people know well about ANOTHR big change.

↓ ↓ ↓

Yes, 2023 is not so coming soon but unfortunately it’s already decided.

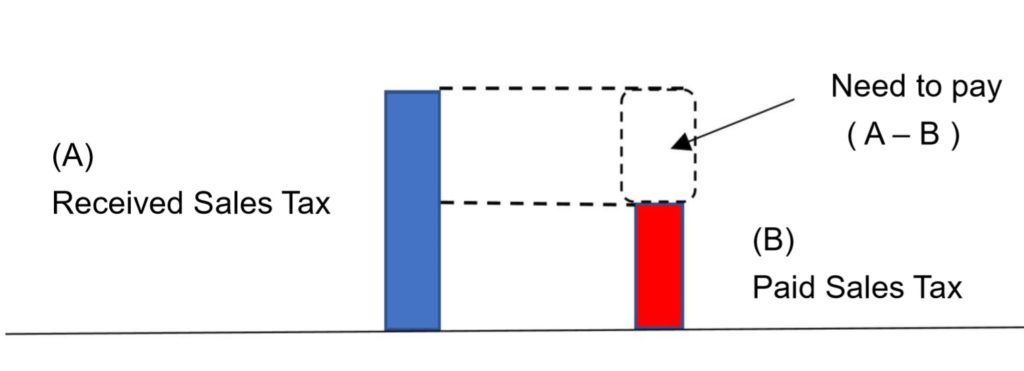

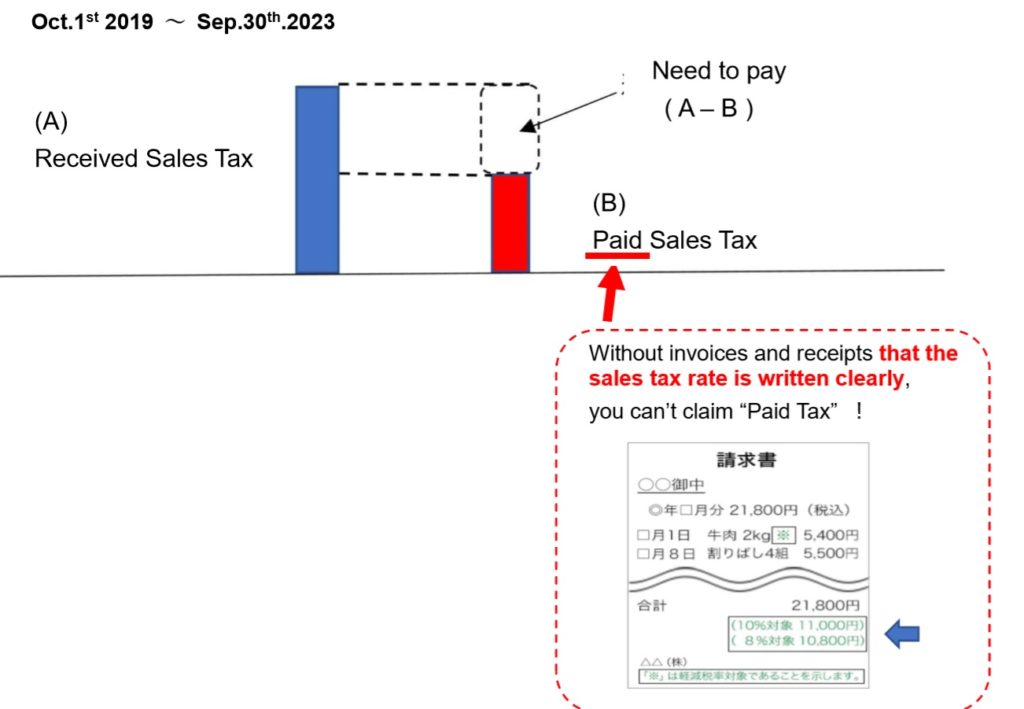

Before let you know detail about the figure (above), I’ll explain about the basic system of Japanese Sales Tax, which can be described as follows;

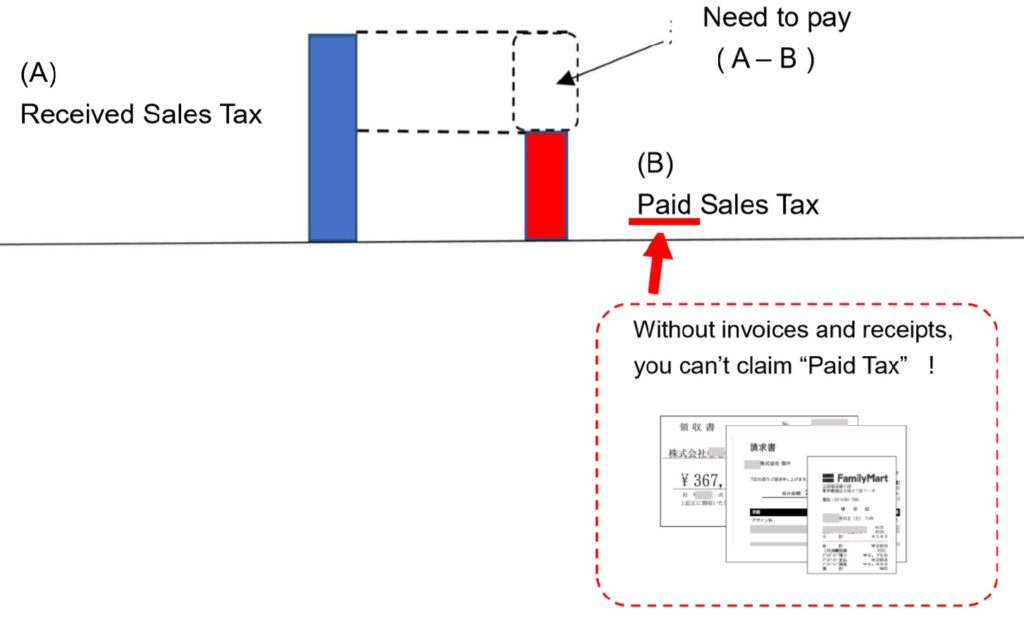

In fact, to claim “Paid Sales Tax”, you must keep receipts and invoices at least for 5 years.

It doesn’t seem very complicated rule.

But, don’t forget about FIRST change that will occured from October 1st 2019.

↓ ↓ ↓

So, all companies ( includes sole proprietor and freelance) that sell foods and the like, will have to issue NEW TYPE of receipts and invoices as I mentioned above.

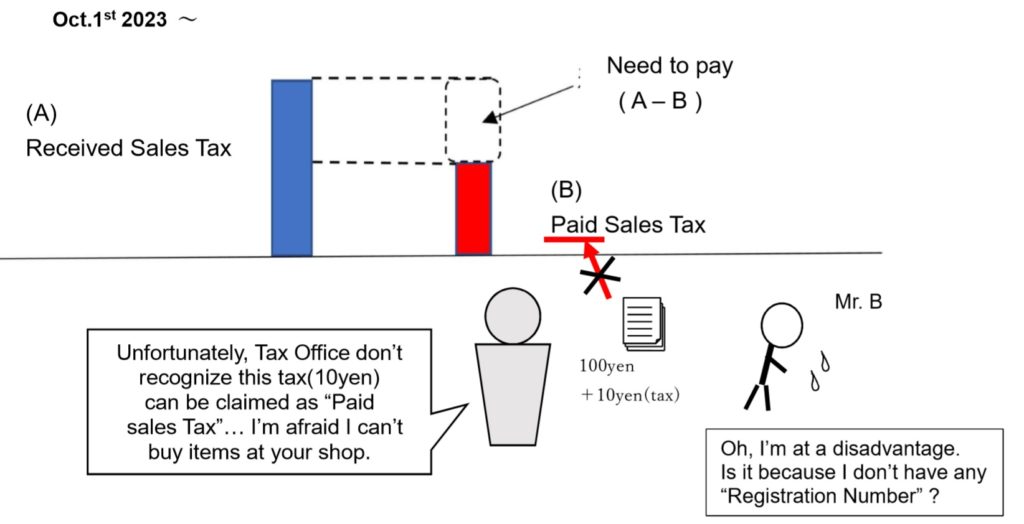

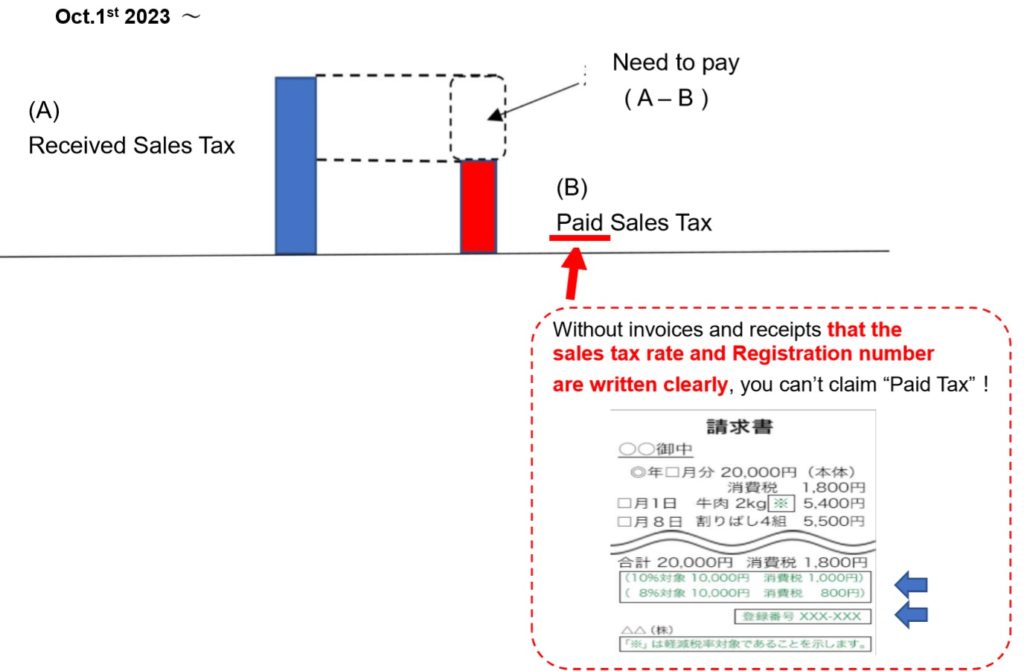

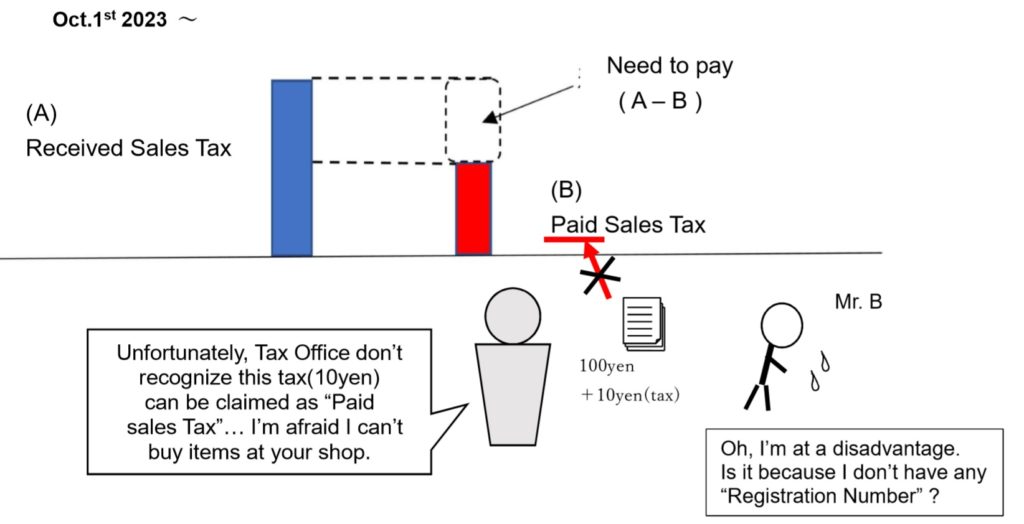

And then, the SECOND change is this (as follows;

↓ ↓ ↓

I think that SECOND one is really hard to small business owners.

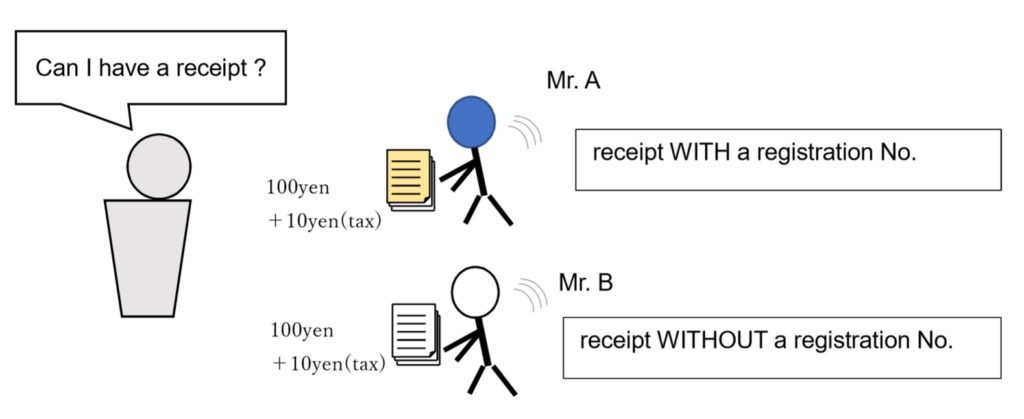

Suppose that a company owner buy some items and ask receipts to venders.

<e.g.>

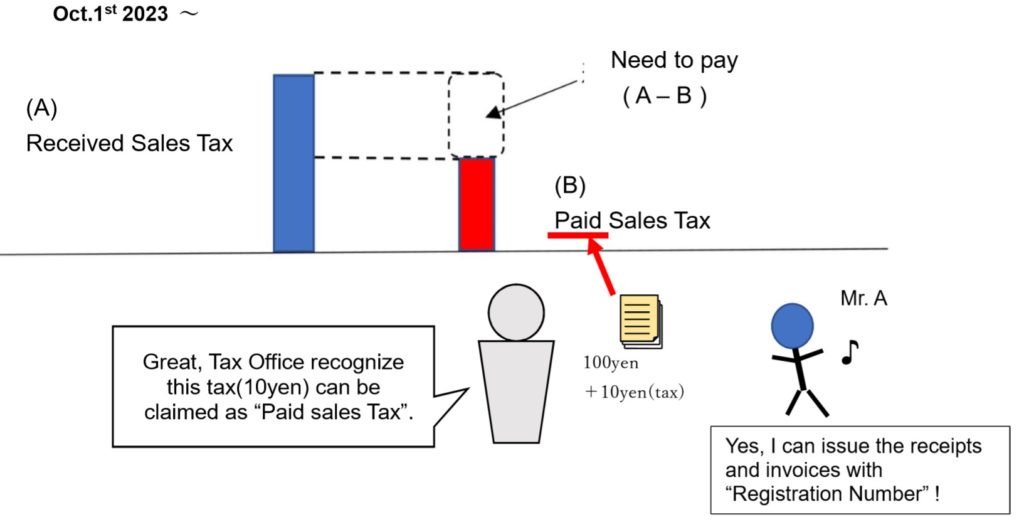

In that case, Mr. A will be at advantage.

But for Mr. B, what do you think ?

In fact, when Mr. B don’t submit the tax filing of Sales Tax, he can’t get Registration Number.

( in most cases, if 2 years ago’s sales amount is less than 10,000,000yen, he doesn’t need to submit Sales Tax Filing. Of course, he CAN do in some cases.)

It’s too hard to small business actually, so there’s an transitional rule 2023~ 2029.

1) from Oct. 1st 2023 to Sep. 30th 2026

… 80% of sales tax can be claimed as “Paid” one, without any Registration Number

2) from Oct. 1st 2026 to Sep. 30th 2029

… 50% of sales tax can be claimed as “Paid” one, without any Registration Number

It’s very complicated so that I can’t believe why Goverment decided these new rules.

Actually, I can’t explain all about them… but don’t worry, you can find a lot of information, at many Website.

Have a nice day 🙂