Hello everyone,

it’s very chilly outside and please take care of yourself. 🙂

And, from February to 15th.March, it’s the tax filing season

and all accountants (of course inculding me) and Tax Office’s staffs

are very, very busy.

So, I’m afraid I’m not available for accepting new clients until

the end of this season, but I know many non-Japanese people

would like to know how much tax must be or must not be paid.

If you’re an president or an employee, you’ll receive your salary

and I believe your employer calculate your tax properly.

Even so, you’d like to know the detail about it ?

Well, I try to explain, not about everything but the most

important points.

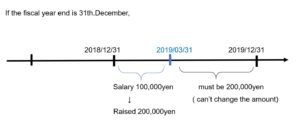

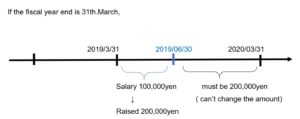

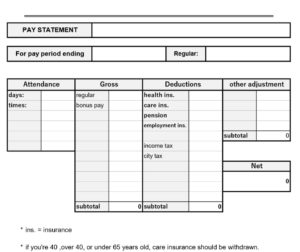

First of all, please take a look at this figure;

↓ ↓ ↓

It seems quite simple but there’re so many rules for it

that many people say it’s complicated, even Japanese.

Today, I’ll tell you the important 6 rules.(below)

:::::::::::::::::::::::::::::::

Rule 1. the salary of president and board members

You can’t change the amount of your salary except during the first 3 months if you’re a president or a board member of company.

In Japan, companys can decide their fiscal year end whenever they like.

If the end is March, the term should be like this;

Rule 2. Bonus pay for of president and board members

Only when this application form has been submitted to Tax Office, they can receive bonus pay.

You must submit it before the bonus would be paid.

The deadline is very strict and complicated and please ask your

accountant in detail …

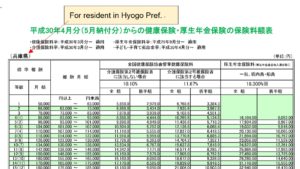

Rule 3. health insurance and pension

First of all, your company should take the procedures about Japanese social insurance. (But it’s not needed for sole proprietor)

If it’s done, you’ll see health insurance/pension is withdrawn.

And the rate is decided not by TaxOffice but by Japan Pension Service and by Health Insurance Association.

The rate is this;

Can you see the notice, “For resident in Hyogo ” ?

Yes, the rate is different from each area in Japan.

My Office is in Hyogo and I must use the “Hyogo” ‘s rate.

If your company is in Osaka, please choose the rate Osaka one.

( of course your employer do it )

Then, employer must pay this health insurance/pension every month.

Half of the amount of payment is consist of withdrawing from employees, and another half is the amount company must owe.

And don’t forget please, the rate is changed every year, mostly on Aprils and company must make the documents and submit it to Japan Pension Service every year.

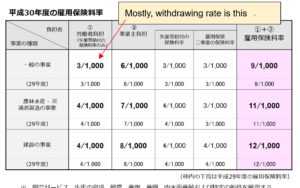

Rule 4. employment insurance

If someone works over 20 hours a week regularly, it should be withdrawn.

( except he/she is a president and a board menber)

The rate is sometimes changed on April.

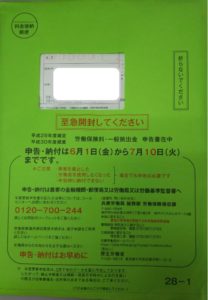

And employer pay this “employment insurance” once a year, at the same time, pay “labor insurance”. ( on June ~ July )

Labor insurance is not allowed to being withdrawn form salary and it’s used for business-related injury.

Employment insurance is supposed to withdrawn from salary and it’s used for dismissal (being fired).

Prefectural Labour Bureau treats these two insurance and they send the document to company like this;

Rule 5. Income tax

Recently many people have more than 2 jobs.

If you works at two companies, one of them would be your “main” company.

When you see two payment letter, the amount of income tax written in your main company’s one must be smaller than the other.

But… who knows which is your “main” company ?

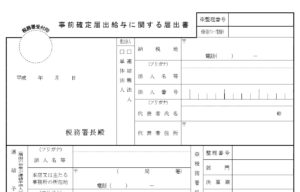

Actually, you told the employer by submitting this form.

You must submit it only to your “main” company when you have 2 or 3 jobs.

And that’s why your employer knows “our company is his/her main job!”.

What if you don’t hand it to them ?

Maybe your income tax rate would be higher.

And one more thing, don’t submit it two companies “at the same time”.

But It’s OK you hand it to B company after leaving A company which you handed it before.(because it’s not “the same time”)

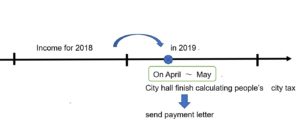

Rule 6. City tax (Local inhabitant tax)

Income tax, health insurance/pension and employment insurance are calculated based on “present” income.

But, City tax is not. It’s calculated last year’s income.

Yes, it’s a little late.

Mostly your company receive the payment letter of your city tax and withdraw it from June because they can’t receive it until May.

What if you would already left the job?

Don’t worry about it, City hall will send it to you directly.

:::::::::::::::::

Well, I’m sorry for writing such long sentenses.

In fact, there’re more detail about it but I’m sure what I mentioned above are the almost.

Have a nice day,

Reiko Nagaoka.